Secure online payments services built for growth

Secure online payments are hassle-free with Access PaySuite. Whether you’re looking to accept one off or recurring payments, our online payment services such as card payments, digital wallets and open banking are quick and simple to set up, provide the highest levels of payment security and compliance and enable you to earn more revenue, more quickly.

Our online payment solutions are trusted by thousands of businesses and organisations

Benefits of securing online payments with our services

Accept online card and digital payments faster

Our online payment solutions are suited for a variety of businesses, ranging from start-ups and growing businesses to established enterprises in sectors like housing and retail. Plus, because we offer a range of card payment methods such as Visa and Mastercard, digital wallets and pay by bank, your customers have the flexibility to choose their preferred payment method, safely and securely.

Everything you need for seamless payments

Payment Flexibility

Offer flexible payment options that suit your customers’ preferences.

- Accept all major credit and debit cards

- Enable payments via PayPal and Apple Pay

- Payment Links sharable across email, social media, SMS

- Native mobile SDKs to collect payments securely

Technology & Integration

Leverage powerful tools and seamless integrations to simplify payment management.

- From fully custom API to pre-built hosted payment pages, we provide a range of integrations to suit your needs

- Access all payment data via a centralised dashboard

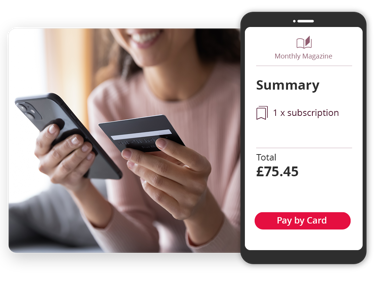

Customer Experience

Deliver a smooth, professional payment experience that enhances customer trust.

- Customisable and mobile responsive branded web pages

- Customer insights through real-time, flexible data and MI Branded payments experience on ANLs (FM Only)

Compliance & Security

Operate with confidence knowing your solution meets the highest industry standards.

- PCI Level 1 security compliance

- Authorised and regulated as a Payment Institution by the Financial Conduct Authority.

- ISO 27001 Certified

Discover our online payment gateway and ecommerce solution

For businesses looking for an online payment gateway service that can be integrated with an ecommerce platform, our secure payment gateway and merchant account solution is fully customisable, allowing you to tailor the look and feel of your payment page to match your brand.

Hear from our customers

All your payments in one place

Online payments FAQs

What are online payment services?

Online payment services allow customers to pay online for your goods and services. They are much more convenient for the majority of customers and help businesses increase their cash flow and make payments more secure. Online payments can be made through a variety of methods such as debit cards, digital wallets and open banking.

How do I take payments online?

To take payments online you’ll first need an online payment system where you can set up a merchant account. This will allow all payments made by customers to go into your account, increasing cash flow for your business or organisation.

How much do online payment platforms cost?

Most online payment systems take a small fee for each transaction made meaning you’ll want to shop around for a system that works for your business. At Access PaySuite, we have no set up fees, just 1.30% for standard UK cards and 20p per transaction.

Ready to get started?

Book a demo or contact our team today to start accepting payments safely and securely